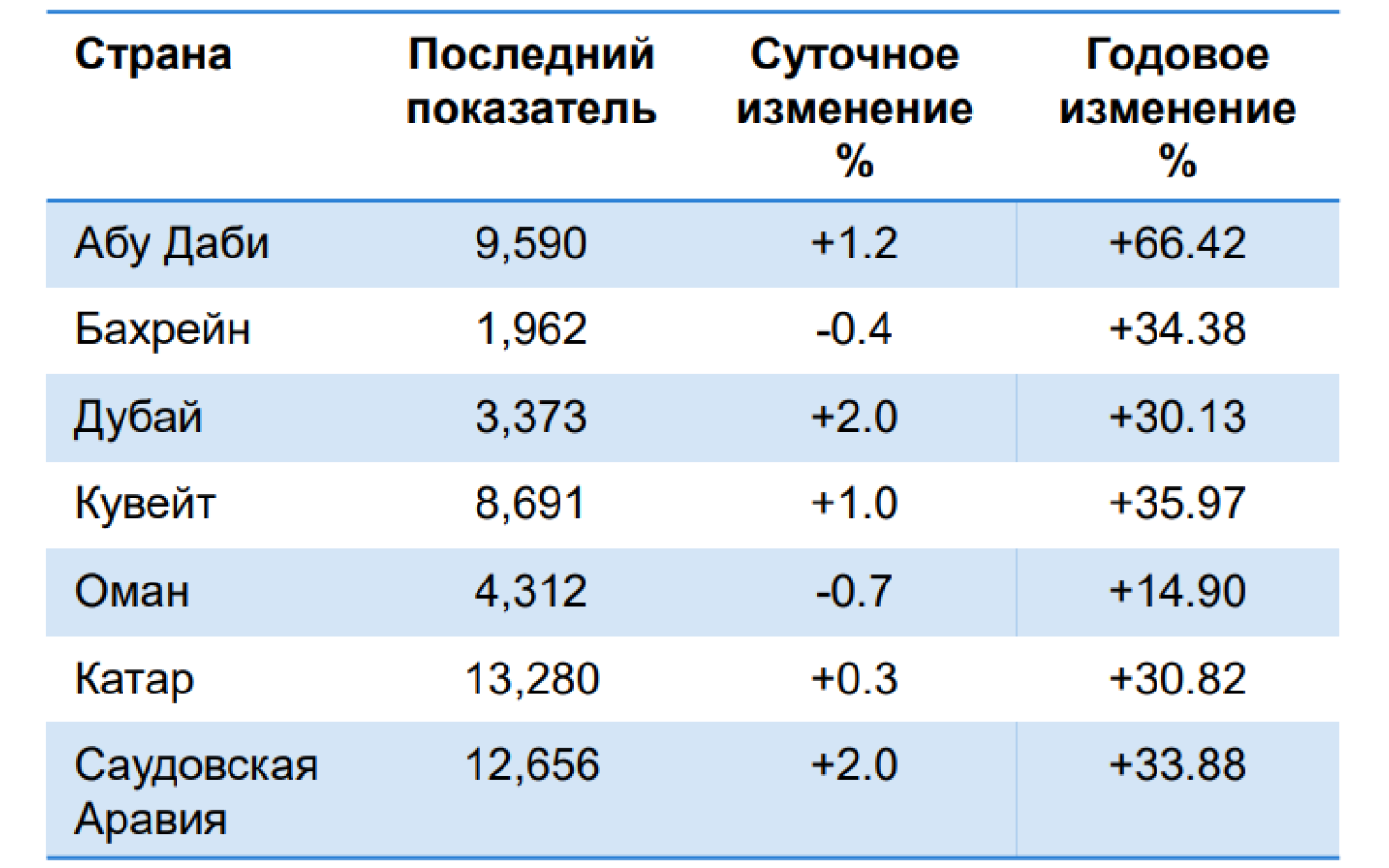

Gulf markets ended higher on 16th March, with Saudi Arabia’s equity index leading the region’s gain on positive economic growth. Saudi Arabia’s GDP growth rose by 6.7% in 4Q21, while full year 2021 GDP growth reported at 3.2%, which were in line with official expectations. The TASI gained 2%, with oil giant Saudi Aramco rising by 5.5%. Elsewhere in the region, Dubai’s DFMG gained 2%, Abu Dhabi’s ADSM ended 1.2% higher, while Qatar’s QE rose 0.3%.With the exception of Bahrain and Oman, break-even oil price is higher, budget sensitive to oil price movements.

Central banks of Saudi Arabia, UAE, Kuwait and Bahrain raised their key interest rates by 25bps in lockstep with the US Federal Reserve to maintain interest-rate parity as their currencies are pegged to the USD. With rising interest rates, GCC borrowing costs will increase but with oil prices over USD97pb, all GCC states are expected to post a fiscal surplus in 2022, reducing the need to raise debt for budget spending.

Japan and Hong Kong led a jump in Asia’s regional stocks on 17th March, joining a rally on Wall Street overnight as potential risks from the US monetary tightening to the Ukraine war and a slowdown in China became less gloomy. According a report from the IMF dated 15th March, spillovers from Russia-Ukraine conflicts are likely to be limited on Asia Pacific region given the lack of close economic ties, but slower growth in Europe and the global economy could take a heavy toll on major exporters.