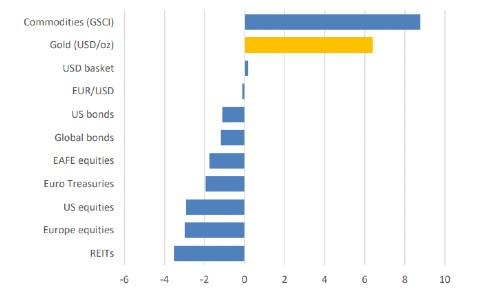

Global commodity prices have risen exponentially in recent months, potential resolution to existing geopolitics could see prices correct significantly. However, gold price is not expected to experience the same level of volatility should there be a price correction, which in turn will enhance gold proposition for effective diversification and portfolio hedge.

This is because (i) global gold supply has not experienced the same magnitude of disruption as other commodities, (ii) sufficient global gold stockpiles, (iii) global gold demand driven by strategic investors looking for longer-term diversification and risk hedging assets, (iv) any price correction provides buying opportunity and this could cushion the impact of potential price pullback.

Reuters poll shows spot gold price forecast of USD1,778.33/oz average in 2022 and USD1,708.47/oz average in 2023.