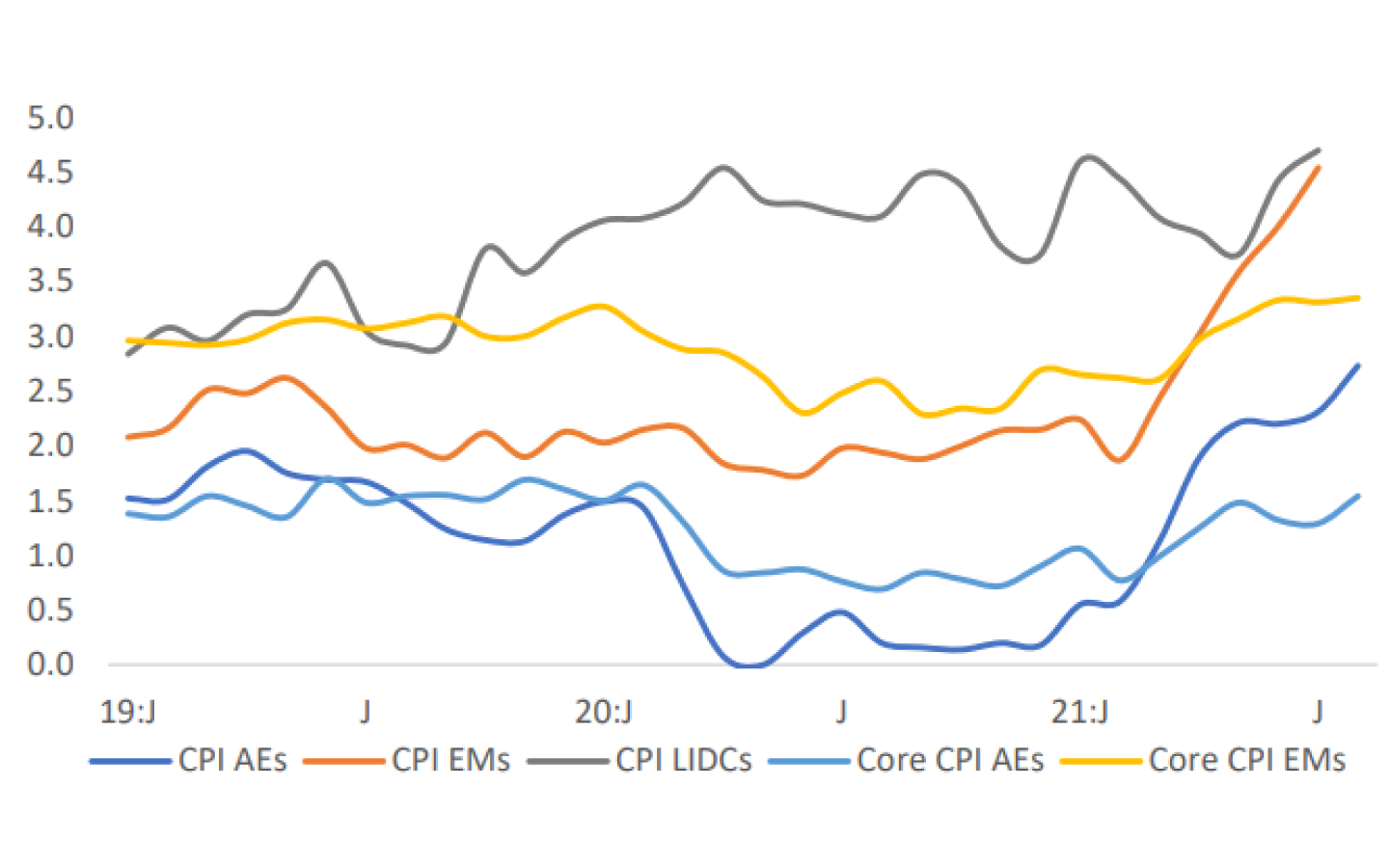

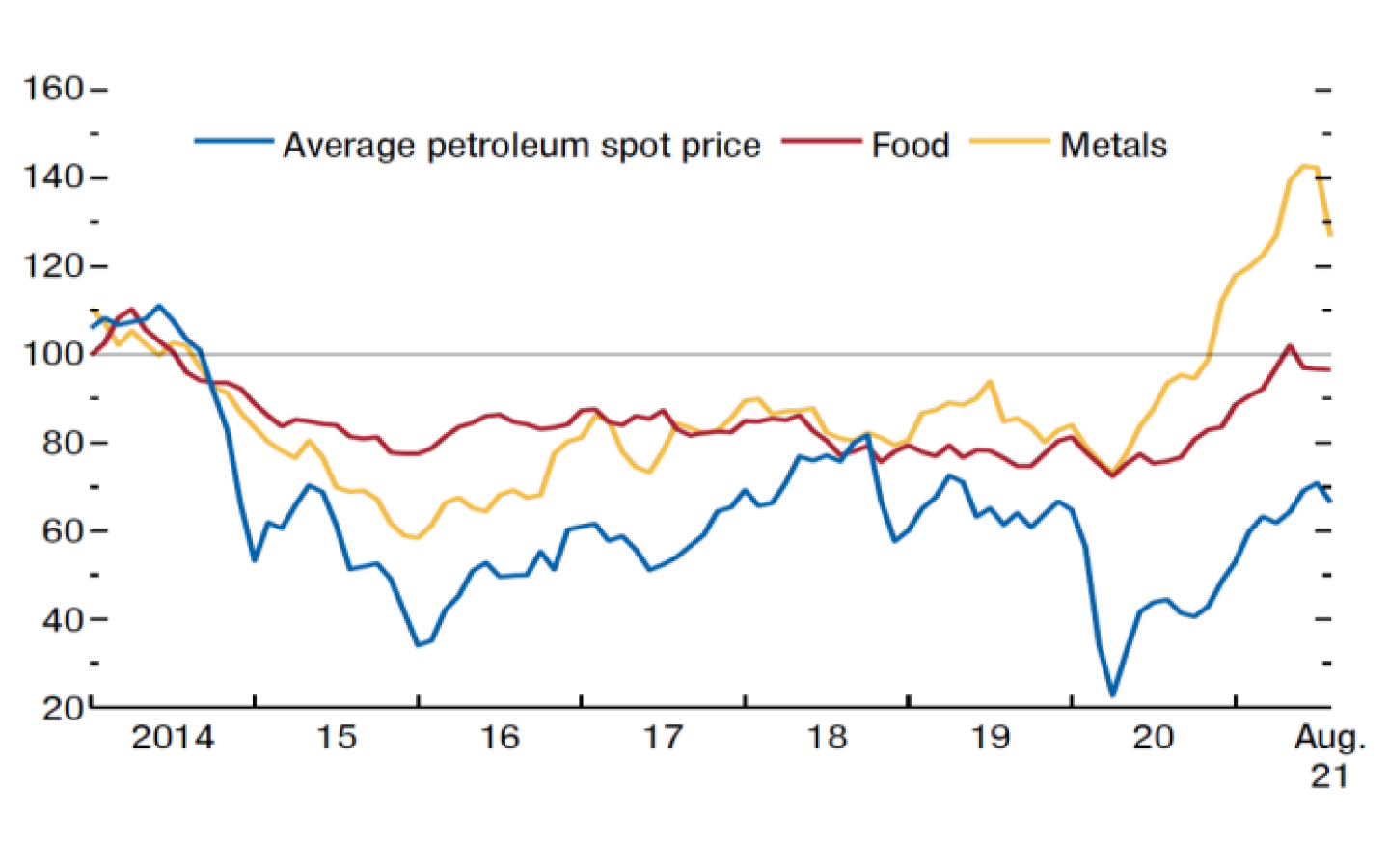

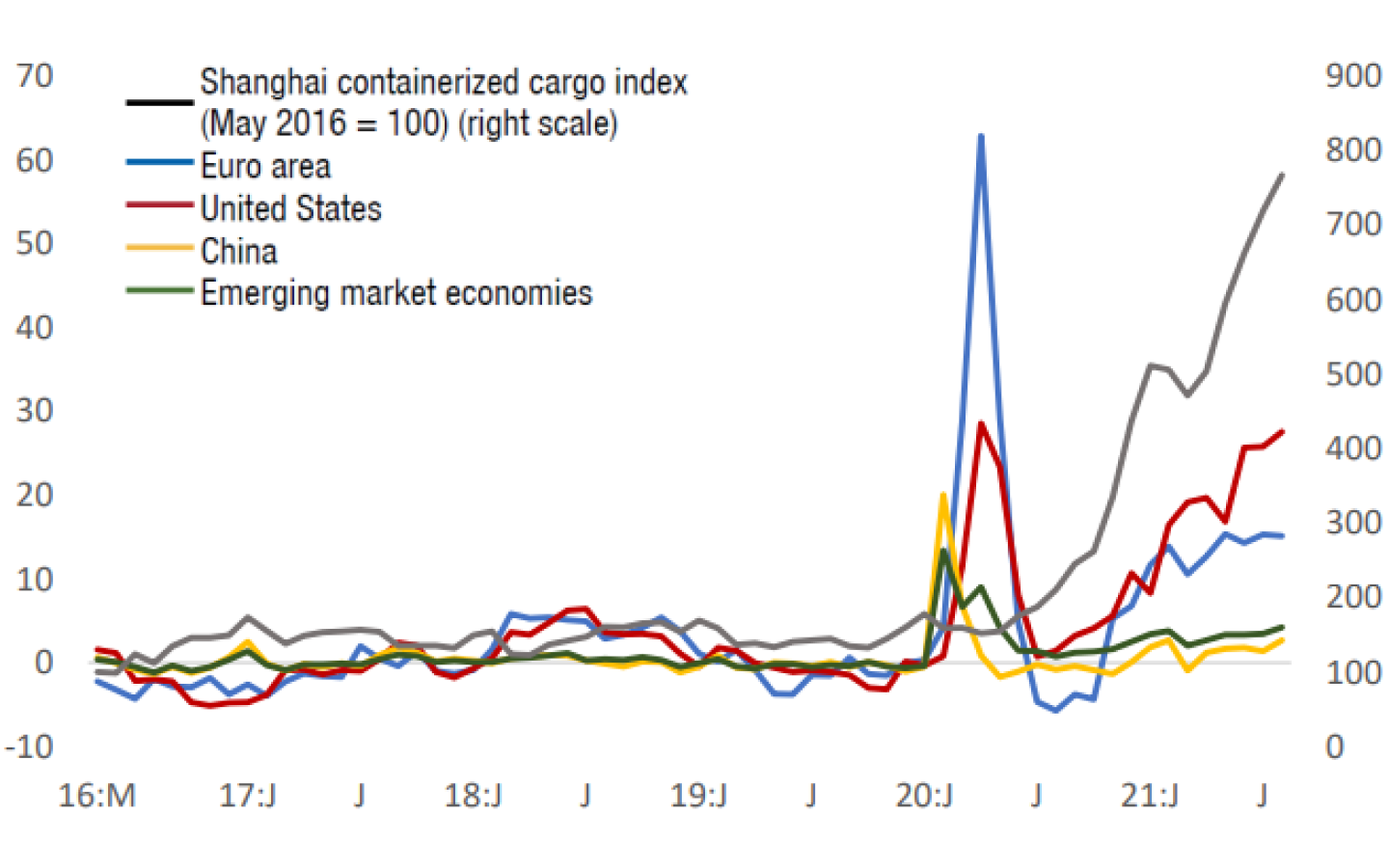

Global inflation has increased since early 2021 driven by firming demand, supply chain challenges & input shortages, rapidly rising commodity prices. Global inflation is expected to come down to pre-pandemic levels in 2022, once supply-demand mismatches resolve.

US Federal Reserve shifts to battling inflation, citing possible first interest rate hike in March. The market has already moved beyond and interest rate futures imply the probability of four or more hikes in 2022 is above 60% and rising. EU inflation stays within medium-term expectations of 2%, ECB has no urgency to follow global peers in winding down monetary stimulus. The European Central Bank expects inflation at 3.2% for 2022, above official target of 2.0%, but easing to 1.8% in 2023-2024. Russia’s inflation expected to remain elevated, monetary policy remains “neutral” to support growth in 2022. The central bank plans to keep the key interest rate above 6% until at least mid-2023 to bring down inflation. CBR expects inflation of 4.0-4.5% by end-2022, and around 4% in the medium-term. Kazakhstan raises key interest rate as inflation remains elevated, official inflation target of 4-6% in 2022. Kazakhstan’s inflation was at 8.4% in Dec, down from a 5-year high of 8.9% in Oct. Inflation is anticipated at 6.0%-6.5% by end-2022, above the official target of 4-6%for 2021-2022. Turkey’s inflation jumped to a 19-year high, unconventional economic & monetary policies saw aggressive interest rate cuts.

Market traders are pricing in the probability of four or more hikes in 2022 above 60% and rising. The 10-year UST yield potentially reach 2% by mid-2022 and 2.5% by end-2022.