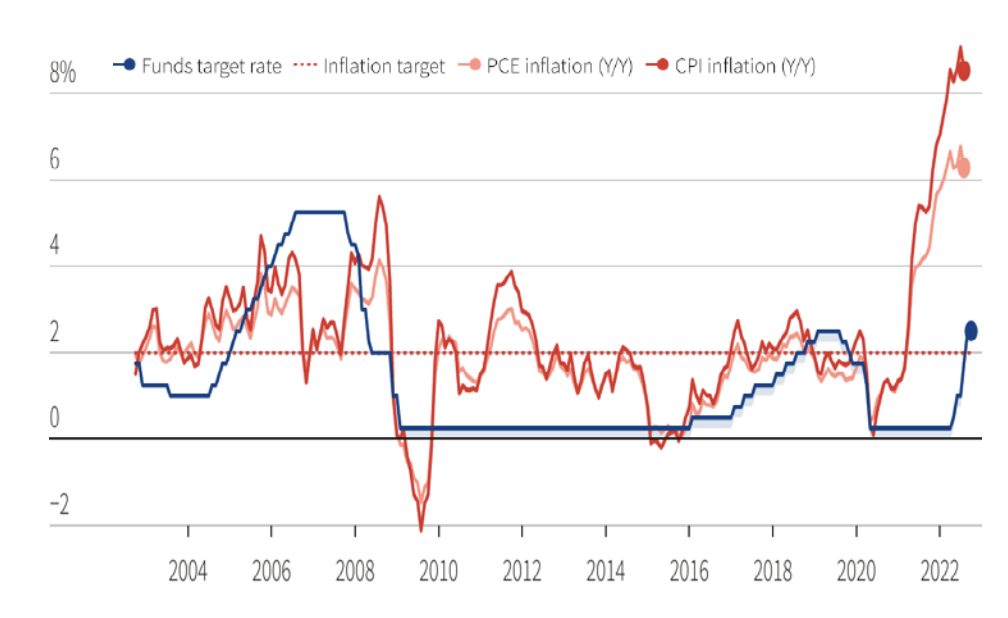

US Treasury yields climbed to the highest levels since June this week on expectations the US Federal Reserve will keep hiking its key interest rate to contain high inflation and new corporate debt supply weighed on the market. The USD index touched a new 20-year high of 110.21 on 6th September, having risen by 15% year-to-date, underpinned by widening interest rate differentials between the US vs. peers.

The Bank of Canada raised its key rate by 75bps to 3.25%, the highest level in 14 years, and signaled further rate hikes are on the cards to contain inflation. The country’s inflation eased to 7.6% in July from 8.1% in June, but the decline was due to a drop in gasoline prices, with the core measures continuing to move higher, according to the BOC. Surveys suggest that inflation expectations remain high.

In line with expectations, the European Central Bank raised its key interest rate by 75bps to 1.25% on 8th September, the highest since 2011 and signaled further hikes to fight inflation even as the euro zone’s economy is heading for a likely winter recession. Euro zone’s inflation is projected to peak at 9% average in 3Q and 4Q of 2022. The ECB lifts its inflation projections again, raising 2023 outlook to 5.5% from 3.5%, and putting the 2024 forecast at 2.3%. The euro hit a 20-year low of $0.9876 on 5th September as the euro zone energy crisis deepens. The euro has weakened 12% vs. USD year-to-date, adding to the already record-high inflation.

Global oil prices traded sharply lower this week, as downbeat China trade data showed crude oil imports fell 9.4% in YoY in August, reignite concerns of recession risks.