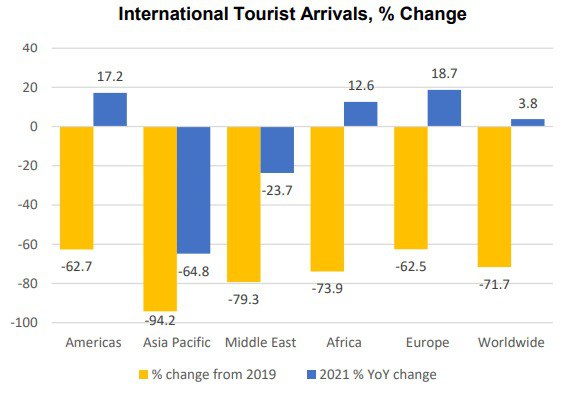

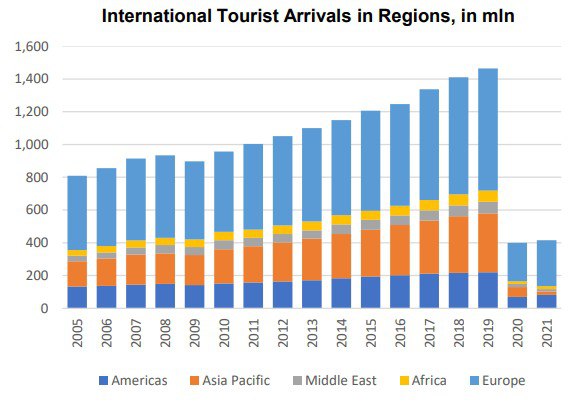

International tourist arrivals rebounded by 3.8% YoY to 415mln arrivals in 2021 (2020: 400mln). However, international tourist arrivals were still 72% below the pre-pandemic level in 2019.

A survey with the panel of UNWTO experts showed that 61% of tourism professionals see better prospects for 2022. While 58% expect a rebound in 2022, mostly during the third quarter, 42% point to a potential rebound only in 2023. A majority of experts (64%) expect international arrivals to return to 2019 levels only in 2024 or later. The UNWTO projects international tourist arrivals globally to grow by 30%-78% in 2022.

International tourist arrivals to Europe is only expected to return to pre-pandemic levels in 2024 or later. Despite this, from a global perspective, Europe’s international tourism in 2022 is projected to recover faster than other world regions, with a notable recovery anticipated from the US market, Europe’s #1 pre-pandemic long-haul source country. Coupled with higher inflation environment (resulting in ADR pricing power), this will in turn bode well for Europe’s hotel demand and performance.

According to auditing & booking platform Tripbam, the room rates in five-star European hotels are on average USD31 more expensive today vs. February 2019. In contrast, the room rates in Asia Pacific region are USD51 lower on average than they were pre-pandemic. Business travelers are gradually returning in Europe, while reducing the number of trips, they opt to stay longer in higher-end hotels, helping to drive up room rates.