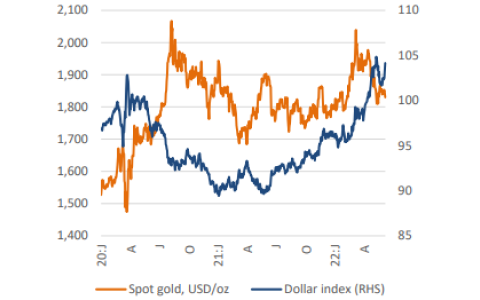

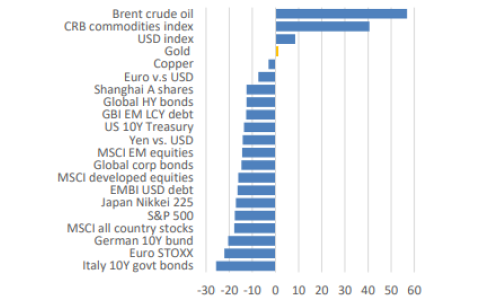

Spot gold gained 1.3% YTD. Spot gold last traded at USD1,830/oz on 10th June, declining by 0.8% on the week following higher-than-expected inflation in May that signaled more US interest rate increases this year. Year-to-date, spot gold gained a marginal 1.3% (vs. USD index +8.5%). US dollar strength and higher interest rates and yields are generally headwinds for gold. Despite this, gold remains one of the better performing assets globally (compared to global equities and bonds which recorded double-digit losses year-to-date).

In 1Q22, global gold demand was 34% YoY higher, driven by strong ETF inflows, and demand from central banks and the technology sector. Meanwhile on supply, global mine production was 3% YoY higher at 856 tonnes in 1Q22, while the supply of recycled gold jumped 15% YoY to 310 tonnes.

Spot gold drivers moving forward: global growth outlook, central banks monetary policies, geopolitics, global inflation, demand and supply dynamics.