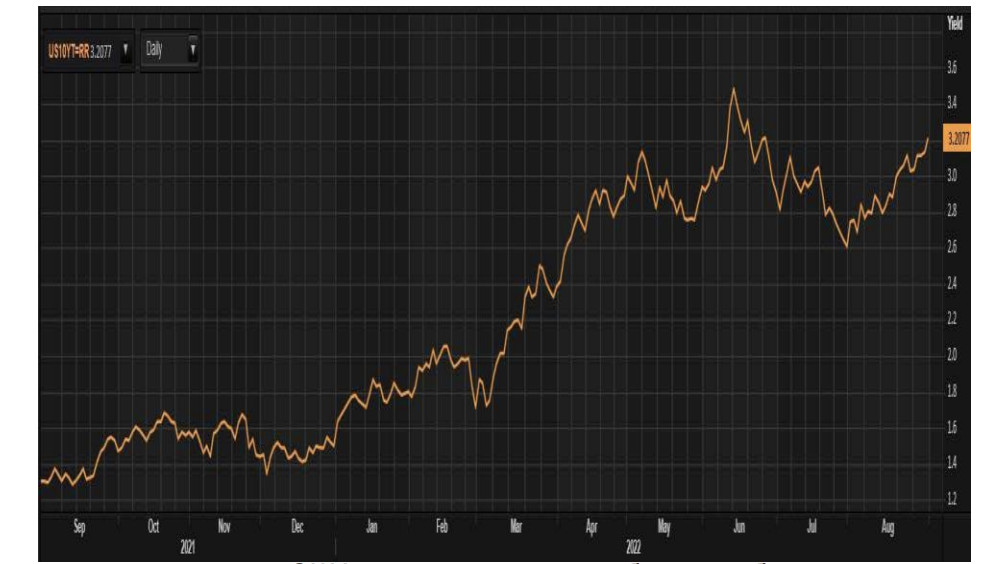

Investors now await the US nonfarm payrolls data due on 2nd September. Earlier data showed that US job openings increased in July and June’s data was revised sharply higher, pointing to strong demand for labor and support the case for more aggressive rate hikes. Traders are now pricing in a 68.5% probability of a 75 bps Fed funds rate hike during 20-21 September FOMC meeting.

US’ three main equity indices experienced their biggest monthly percentage declines in August since 2015. Investors expect US equities to remain volatile, with concerns that markets could move towards new lows in September. The USD index traded around 108.66, slightly below a 20-year high of 109.48 recorded on 29th August. On the month, the USD index rose 2.6%, on track for a third straight monthly gains.

Euro zone’s inflation surged to another record high of 9.1% in August vs. 8.9% in July, driven by high energy and food prices. Concurrently, Germany’s inflation rose to a 50-year high of 8.8% in August vs. 8.5% in July. Without any follow-up government measures, Germany’s inflation could potentially hit double digits before end-2022. UK 2-year bond yields surged 25bps to the highest since 2008.

Global equity funds saw largest weekly capital outflows in 5 weeks ended 24th August on global growth concerns. US bond funds recorded biggest net weekly outflows in 8 weeks, while equity funds posted net weekly outflows after 2 weeks of net purchases. Asian equities traded on cautious sentiment as investors eye more monetary tightening from the US.