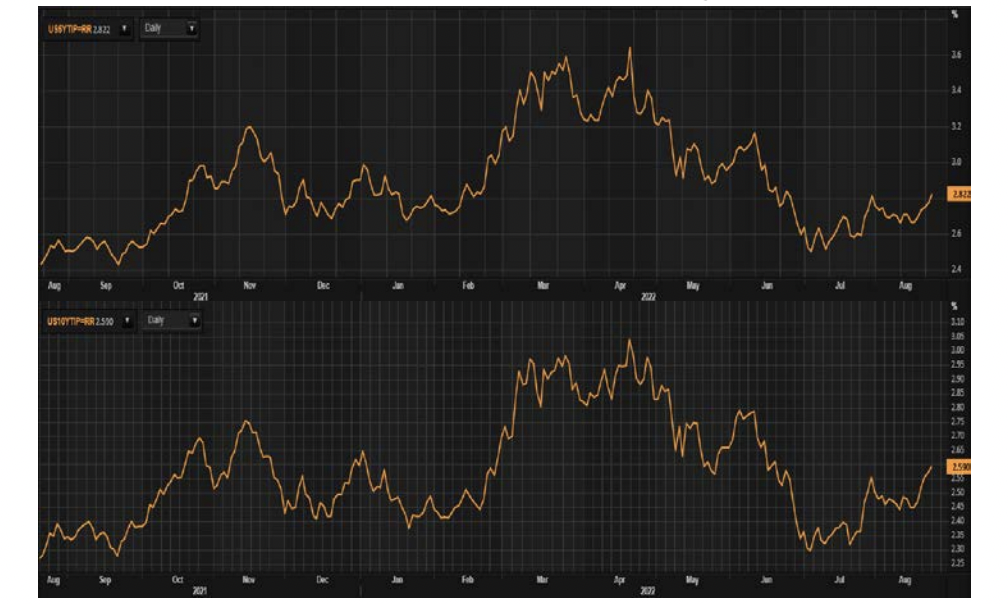

US 10-year Treasury yields touched 5-week highs, while the 20 and 30-year yields hit 6 and 8-week highs respectively. The 10 and 30-year yield each widened by 3bps to 3.0628% and 3.2712% respectively on 23rd August. Meanwhile, the 2-year yield traded 3.7bps higher to 3.2997%.

The USD index has gained 22% since its uptrend in May 2021 to reach 109 as of today. Technical analysis shows that the USD index could climb another 10% to 120 based on current momentum.

Europe’s natural gas prices hit another record high of €272/MWh on 22nd August, up from previous close of €245/MWh. Meanwhile, UK gas for immediate delivery was up 125 pence to 490 pence per therm, while the day-ahead contract rose 123 pence to 484 p/therm. The euro dipped 0.15% to $0.9926, having dropped to a 20-year low of $0.99005 on Tuesday intraday trades. The break below July’s $0.9952 was taken as a bearish sign for a further push lower. The euro shed close to 3% in August and >12%year-to-date. Market players expect the Euro to dip to $0.96 by December.

China cut benchmark lending rates, in line with market expectations, in efforts to revive economic growth.

Global oil prices pared losses after OPEC said it stands ready to cut oil output to boost prices, USD strength a drag on spot gold.