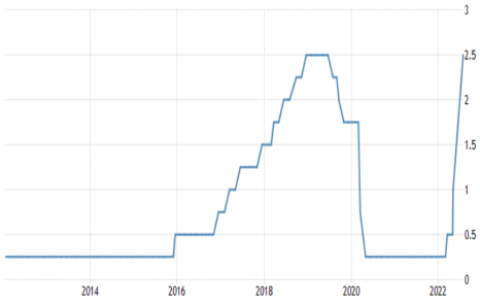

US Fed Reserve raised interest rate by 75bps to 2.25%-2.5%, reinforced commitment to contain inflation. The policy rate is now at the level most Fed officials feel has a neutral economic impact. The policy rate also matches the high point of the central bank’s previous tightening cycle from late-2015 to late-2018, a level reached this year in the span of just four months. Monetary policy decisions will be data-dependent. Investors expect the Fed to raise its policy rate by at least 50bps at its 20-21 September meeting.

US Treasury yields eased, driven by flight to safety following concerns of US and Europe economic slowdown. The yield spread between 2- and 10-year Treasury notes has been inverted for more than two weeks and widened a bit further at -25.7bps, before easing to -19.1bps. An inverted yield curve is seen as a recession signal when the short-end yield is higher than the long-end.

The US dollar bull run may not be over yet – the US Fed Reserve is expected to lift the its key rate by 50bps during September meeting, global growth is slowing and the downside risks are intensifying.