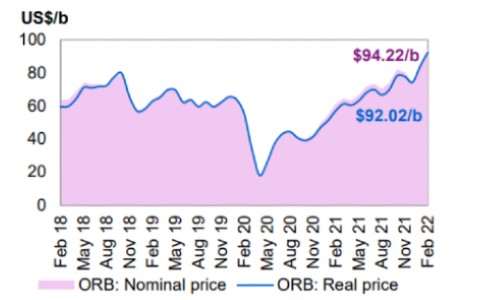

Global oil prices fell 13% in the final week of March, after the US announced that it will release 1mln bpd of oil for six months from its strategic oil reserves starting May. This is in addition to the 30mln to 50mln barrels of oil which could be released by other IEA members.

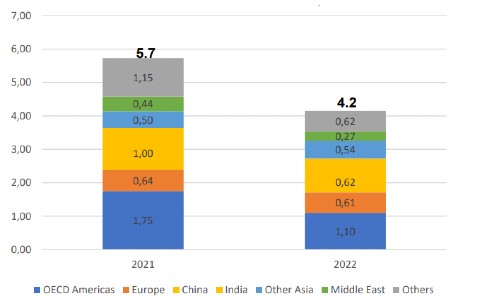

The US oil reserves release is expected to ease but not alleviate a potential global oil supply deficit. Expect continued volatility in global oil prices. In particular, global oil demand growth is projected at 4.2mln bpd (or +4.3% YoY) to 100.90mln bpd in 2022, with OECD demand growth forecast at 1.9mln bpd and non-OECD at 2.3mln bpd.

2022 oil demand growth drivers: (i) robust oil usage in the transportation, industrial & trade-related sectors in OECD Americas, Europe and Asia Pacific, (ii) petrochemical industry demand in Americas, South Korea and Japan, (iii) competition in gas markets support fuel switching in some in Europe and Asia Pacific markets.