The USDRUB exchange rate fell 3.1% on 21st February and slipped past the 80-level. It continues to weaken to a height of 80.9275 on 22nd February intraday trade, before closing at 78.7110. Year-to-date, the ruble has fallen 5.6% against USD (3rd January: 74.5508). Against the euro, the ruble lost 3.1% to 90.23 on 21st February after hitting 90.7850 on intraday trade, a level last seen in April 2021. The ruble touched a high of 91.4059/EUR on 22nd February intraday trade. Year-to-date, the ruble has weakened 5.9% against the euro (3rd January: 84.26).

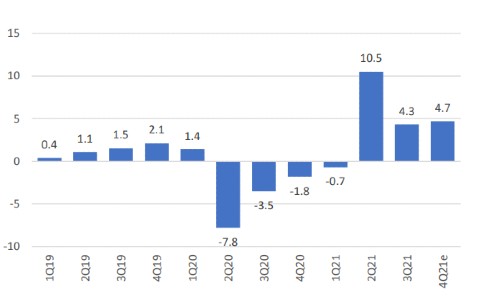

Russia’s GDP growth was resilient, estimated at 4.7% in 2021, a recovery from 2.7% contraction in 2020. A further increase in steady growth rates of Russia’s economy will be conditional primarily on the growth paces of labor productivity. The central bank expects Russia’s GDP growth of 2-3% in 2022 (2021e: 4.7%), returning to a balanced growth path of 1.5-2.5% in 2023 and 2-3% in 2024.

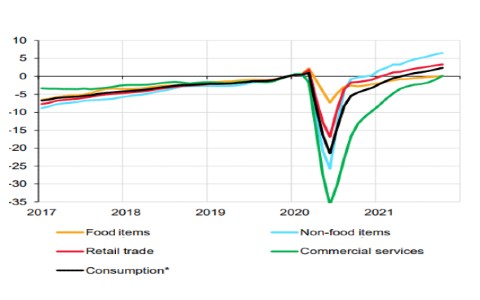

Consumption of commercial services is now close to pre-pandemic level, growing domestic & external demand and high corporate profits shore up investment activity. Russia’s unemployment rate has fallen to a record low, inflation pressure from the labor market has intensified due to labor shortages.