US Federal Reserve minutes indicate more rate hikes in the pipeline, however the pace of rate hike could slow. The July minutes indicate that the pace of future rate hikes would be data-dependent moving forward. Inflation eased slightly to 8.5% in June from 9.1% in May. Some parts of the US economy especially housing, had begun to slow under tighter credit conditions. The labour market however remained strong and unemployment rate stood at a near-record low.

Benchmark 10-year yields narrowed by 2bps and the 2-year yields fell 5bps immediately after the minutes were released. However, both the 10 and 2-year yields closed the day higher at 2.894% and 3.293% respectively. The Treasury yield curve inversion was at -39.29bps as at 17th August.

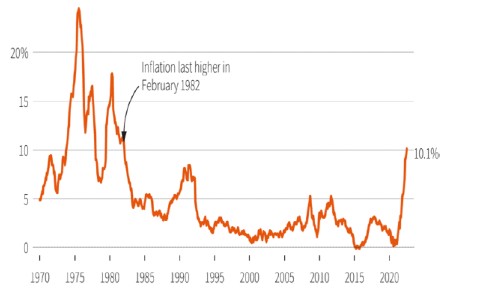

UK’s inflation jumped to 10.1% in July from 9.4% in June, the highest since February 1982 and above market expectations of 9.8%. The Bank of England projects UK’s inflation to peak at 13.3% in October, when regulated household energy prices increase. Two-year gilt yields surge on inflation data and expectations of further rate hikes, while the pound held steady. UK’s economic snapshot: GDP fell by 0.6% in June, dragged down by services, production and construction sectors.

Euro zone economic growth was resilient, with GDP growth of 3.9% YoY and 0.6% QoQ in 2Q22 (1Q22: 5.4% YoY and 0.5%QoQ), slightly lower than earlier official estimates of 4.0% YoY and 0.7% QoQ. Employment rose 2.% YoY and 0.3% QoQ in 2Q22. The market expects 2Q22 to be the final quarter of growth before higher inflation and supply chain challenges potentially lead the euro zone into a mild recession over the next 12 months.

China unexpectedly cut interest rates on key lending facilities to boost economic recovery. China’s GDP growth forecasts were revised downward by 0.4%-1.0% to range between 4.0%-4.5% in 2022, with official GDP growth target of 5.5% being a challenge to meet. The PBOC needs to achieve balance between stimulus measures while avoiding adding on to inflation and capital outflows.

Global oil prices rose 1.5% after hitting 6-month lows on global growth concerns, spot gold held steady.