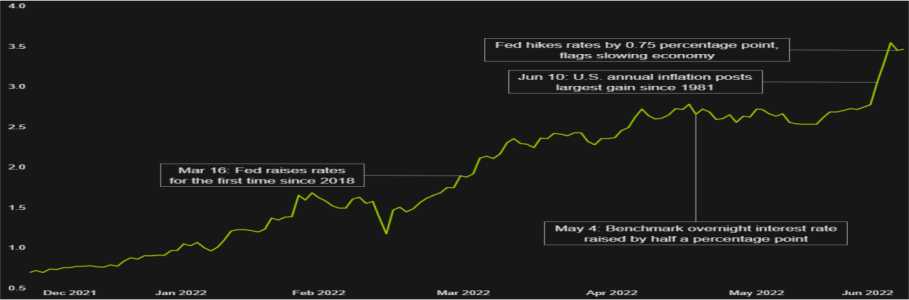

The US Fed Reserve raised its benchmark interest rate by 75bps to a range of 1.5%-1.75% on 15th June, its biggest policy rate hike since 1994, to stem a surge in inflation. US’ inflation unexpectedly accelerated further to 8.7% in May vs. 8.3% in April. The US central bank is expected to continue hiking interest rates aggressively as it faces soaring inflation. Fed fund futures traders are pricing in a 78% probability of a 75bps rate hike in July, and a 22% probability of a 50bps rate increase.

US Treasury yields surged to more than 10-year highs on expectations of aggressive rate hikes for the remaining of 2022. Elevated global inflation and widening price pressures have led to key central banks raising respective policy rates.

Global equity funds declined over 20% year-to-date, while global bond funds fell over 6%. Commodity funds were resilient posting gains of >28%.